Measurement of National Income (Simple English Explanation)

What is National Income?

National income is the total worth of all the final goods and services that are created inside a country in one year.

Main Methods to Measure National Income

Economists use three important approaches to calculate a country’s national income.

Value Added Method

Income Method

Measurement of National Income

Expenditure Method

Let’s understand each method in a simple way.

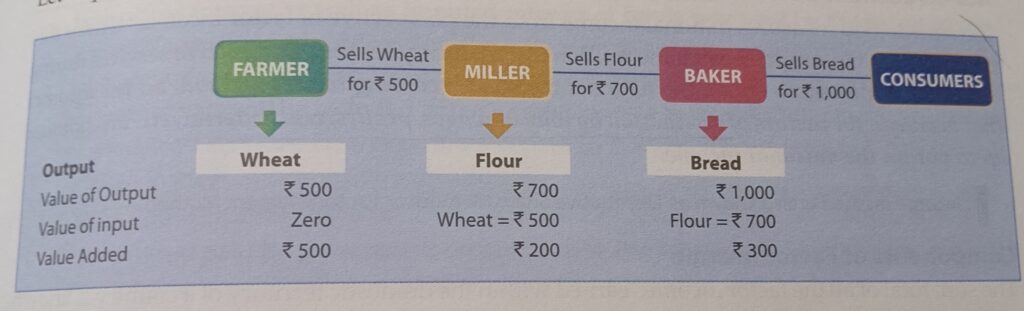

1. Value Added Method

This method measures national income by finding the value that each producer adds to the raw materials and intermediate goods during production.

Steps:

Calculate Value Added: Value Added = Total Output – Intermediate Goods Used

Add up Value Added: Calculate the value added at every production stage (farmer, miller, baker, etc.), then add them all.

For example, if a carpenter buys wood for ₹600, then makes furniture and sells it to a wholesaler for ₹900, and the wholesaler sells it to customers for ₹1,200, the value added is the total added at each step (i.e., ₹600 + ₹300 + ₹300 = ₹1,200).

Important Points:

Only final goods are included to avoid double counting (counting the same item more than once).

Value of unsold output and self-use (like food grown and eaten by the farmer) should also be included.

2. Income Method

This method adds up all incomes earned by people for producing goods and services. These include:

Compensation of Employees (wages, salaries, etc.)

Rent

Interest

Profit

Mixed Income (income of self-employed people like shopkeepers, farmers, etc.)

Steps:

Combine all earnings such as salaries, land rent, interest on capital, company profits, and earnings of people running their own work.

Get the total Net Domestic Product at Factor Cost (NDPfc).

National Income = Addition of wages, rent, interest, profits, and earnings of self-employed people

3. Expenditure Method

This approach measures national income by adding all spending on goods and services consumed in the economy.

The four main components:

Private Final Consumption Expenditure (PFCE): Expenses by households.

Government Final Consumption Expenditure (GFCE): Expenses by the government.

Gross Domestic Capital Formation (GDCF): Spending on assets like machines, tools, buildings, etc.

Net Exports (Exports – Imports): Difference between what we sell to and buy from foreign countries.

Formula: GDP = PFCE + GFCE + GDCF + (Exports − Imports)

Precautions to Avoid Errors

Use only final goods in the calculation, not goods used during production, to stop repeated counting.

Include only incomes from production activities within the country’s economic territory.

Exclude transfer payments (like pensions, scholarships, gifts), capital gains (profits from sale of assets), and goods not produced during the given year.

For self-consumption (goods produced and used by the same person), estimate their value and include in national income.

Treatment of Key Items

Depreciation: Reduce GDP by the depreciation of capital assets to get NDP.

Net Factor Income from Abroad (NFIA): Add any income earned from abroad and subtract what we pay to foreigners.

Market and Factor Prices: Know the difference while calculating (Market Price includes taxes, Factor Cost does not).

Example to Understand Double Counting

If wheat is counted as output, and then bread made from that wheat is also counted again as output, the same good is being added more than once. Double counting can be avoided by calculating the value added at each step or by considering only the final product’s value.

GDP, NDP, GNP, and NNP: Key Terms

GDP (Gross Domestic Product): Total final output produced within the country.

NDP (Net Domestic Product): GDP minus depreciation.

GNP (Gross National Product):GNP refers to the total value of GDP along with the income received from other countries.

NNP (Net National Product): GNP minus depreciation.

Measurement of National Income

Conclusion

Knowing the national income gives us an idea of how much goods and services a nation makes and how much income is earned by its people. It is measured using three main methods: Value Added, Income, and Expenditure. Accuracy is important, so we must avoid counting the same goods twice and only include what was truly produced during the year.