Class 12 Economics Notes: Factor Income, Transfer Income, Final Goods, and NFIA

🔹 Introduction

People earn income in various ways, and goods in the economy serve different purposes. To understand the economy better, we must learn about the types of income people receive and how goods are classified. This article explains key concepts like Factor Income, Transfer Income, Final vs Intermediate Goods, and Net Factor Income from Abroad (NFIA) in a simple and clear way.

🔹 1. Factor Income and Transfer Income

What is Factor Income?

Factor income is the money received by individuals or firms in exchange for offering their services in the production process. These services include land, labour, capital, and entrepreneurship.

- Example: Payment received for using land, salary for providing labour, return on invested capital, and gain from business activity.

What is Transfer Income?

Transfer income is the money received without giving any kind of productive service in return. It is not earned through any economic activity.

- Example: Scholarships, old-age pensions, unemployment benefits, donations.

🔁 Key Differences

| Point | Factor Income | Transfer Income |

|---|---|---|

| Meaning | Earned through productive services. | Received without performing any work. |

| Included in NI? | Yes, counted in National Income. | No, excluded from National Income. |

| Concept Type | Considered an earning. | Considered a receipt. |

| Recipient | Received by those who work in the production process. | Received by households or government as support. |

✔ Remember: Only factor income is part of national income as it reflects real production.

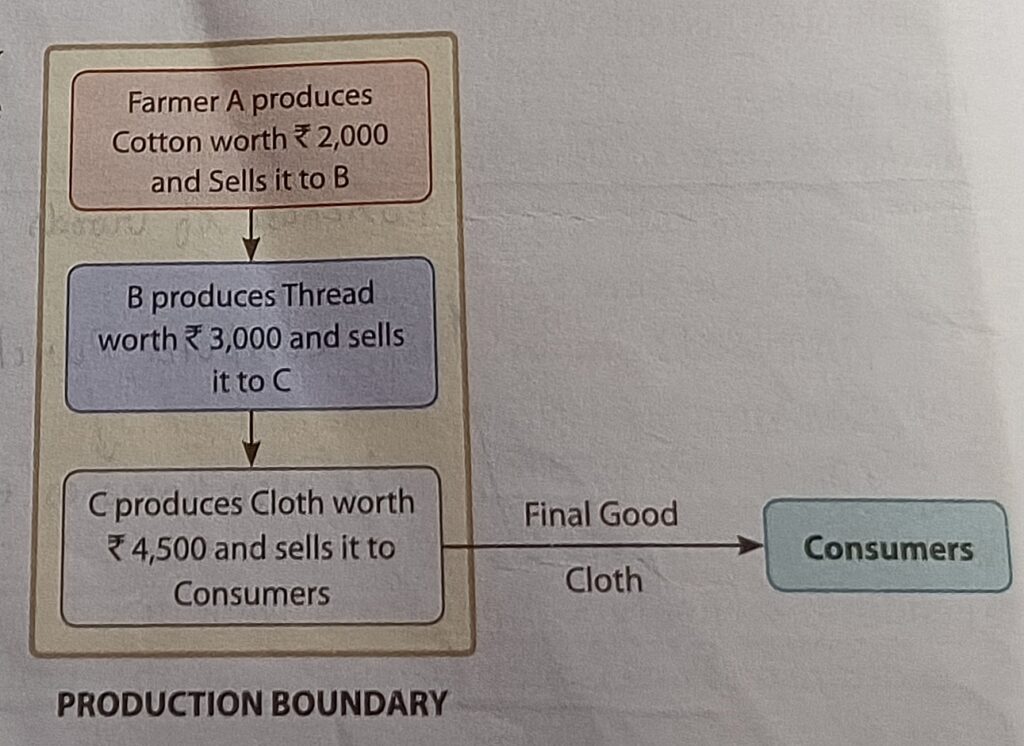

🔹 2. Final Goods and Intermediate Goods

Final Goods

Final goods are those that are either used by consumers to satisfy needs directly or utilized by firms to grow or produce more goods. They are not meant for resale or for use in further production.

✅ Examples:

- For consumption: Milk bought by a family.

- For investment: Machinery purchased by a company.

Spending on final goods is classified into two types:

- Consumption Expenditure (households)

- Investment Expenditure (producers)

Intermediate Goods

These are inputs that go into the making of final products. They can’t be used directly and often require further conversion or manufacturing.

Examples:

- Raw materials, flour used in making bread, wood used in making furniture.

📌 Note: Intermediate goods are not counted separately in national income as their value is already included in final goods.

🔹 3. Net Factor Income from Abroad (NFIA)

What is NFIA?

Net Factor Income from Abroad (NFIA) means the net earnings from the foreign sector—that is, how much people in a country earn from the rest of the world minus what foreigners earn from within the country.

Formula:

NFIA = Income received from abroad − Income paid to abroad

✳ Components of NFIA:

- Net Compensation of Employees

- Net Income from Property and Entrepreneurship

- Net Retained Earnings

(Portion of income kept by businesses after settling taxes and paying out dividends.)

📌 Important Concept:

In a country that doesn’t deal with other nations for trade or investment (called a closed economy), NFIA becomes zero because there is no cross-border income flow.

Let’s Solve Some Examples:

✅ Case 1:

- Income from abroad = ₹500

- Income paid abroad = ₹300

NFIA = 500 − 300 = ₹200

✅ Case 2:

- Income from abroad = ₹250

- Income paid abroad = ₹620

NFIA = 250 − 620 = −₹370

✅ Case 3:

- Only income paid abroad = ₹150

NFIA = −₹150

✅ Case 4:

- No income received from abroad, but ₹150 paid

NFIA = −₹150

🔄 Summary of Concepts

| Term | Meaning |

|---|---|

| Factor Income | Income earned by offering services in production. |

| Transfer Income | Income received without providing services. |

| Final Goods | Goods used for consumption or investment. |

| Intermediate Goods | Goods used in making other goods, not for direct use. |

| NFIA | Net earnings from foreign sector after subtracting what is paid to abroad. |

Final Words

These basic concepts are building blocks of National Income Accounting and form the core of Macroeconomics. Always remember:

- Factor income = Earned through effort or production.

- Transfer income = Support received without effort.

- Final goods = Ready for end-use.

- Intermediate goods = Used to make other goods.

- NFIA = Reflects net income flow between nations.

📌 Bonus Tip for Students:

Practice NFIA numericals and revise key differences using tables and flowcharts. Create flashcards for important terms like “Final Goods”, “Transfer Income”, and “Retained Earnings”.